TVS Digital is an AI-driven fintech ecosystem that powers efficient loan management and collections for automotive brands across Asia.

- Role UI/UX Design Intern

- Timeline 6 Months

- Tools Figma, Adobe Illustrator

Project Background

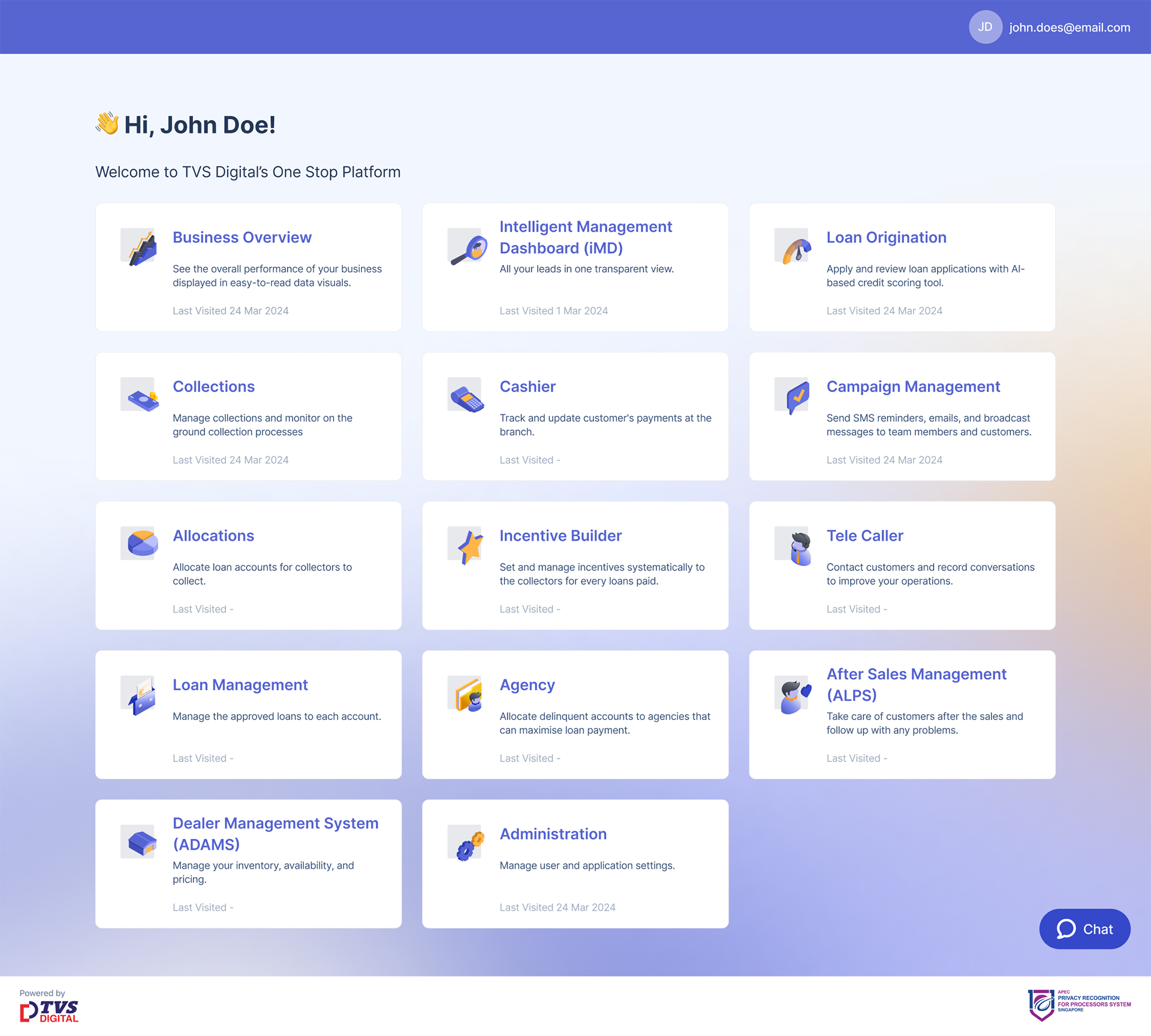

TVS Digital builds AI-powered solutions for the fintech and automotive sectors, supporting brands like Mazda, Honda, and Wheeltek across Asia. Its platforms help businesses manage loan origination, credit decisioning, collections, and field operations more efficiently. During my internship, I designed key parts of the Unified Portal, a centralised system created to consolidate multiple loan and collections workflows into one streamlined interface. The portal improves visibility, reduces manual processes, and helps branch teams make faster, data-driven decisions.

Main Responsibilities

I was responsible for designing end-to-end flows for the Loan Management and Cashier modules. This included understanding requirements, mapping user journeys, creating wireframes and prototypes to ensure consistency with the unified design system. I worked closely with product managers and designers to simplify complex workflows such as payment recording, memo tracking, and loan status management and translated them into clear, usable screens for branch officers.

Branch officers can check approved loan applications, confirm customer and loan details, and disburse the loan in the same system.

Branch officers can record customer payments, add memos or promises to pay, and view collection records in one place.

Fragmented Loan Management System

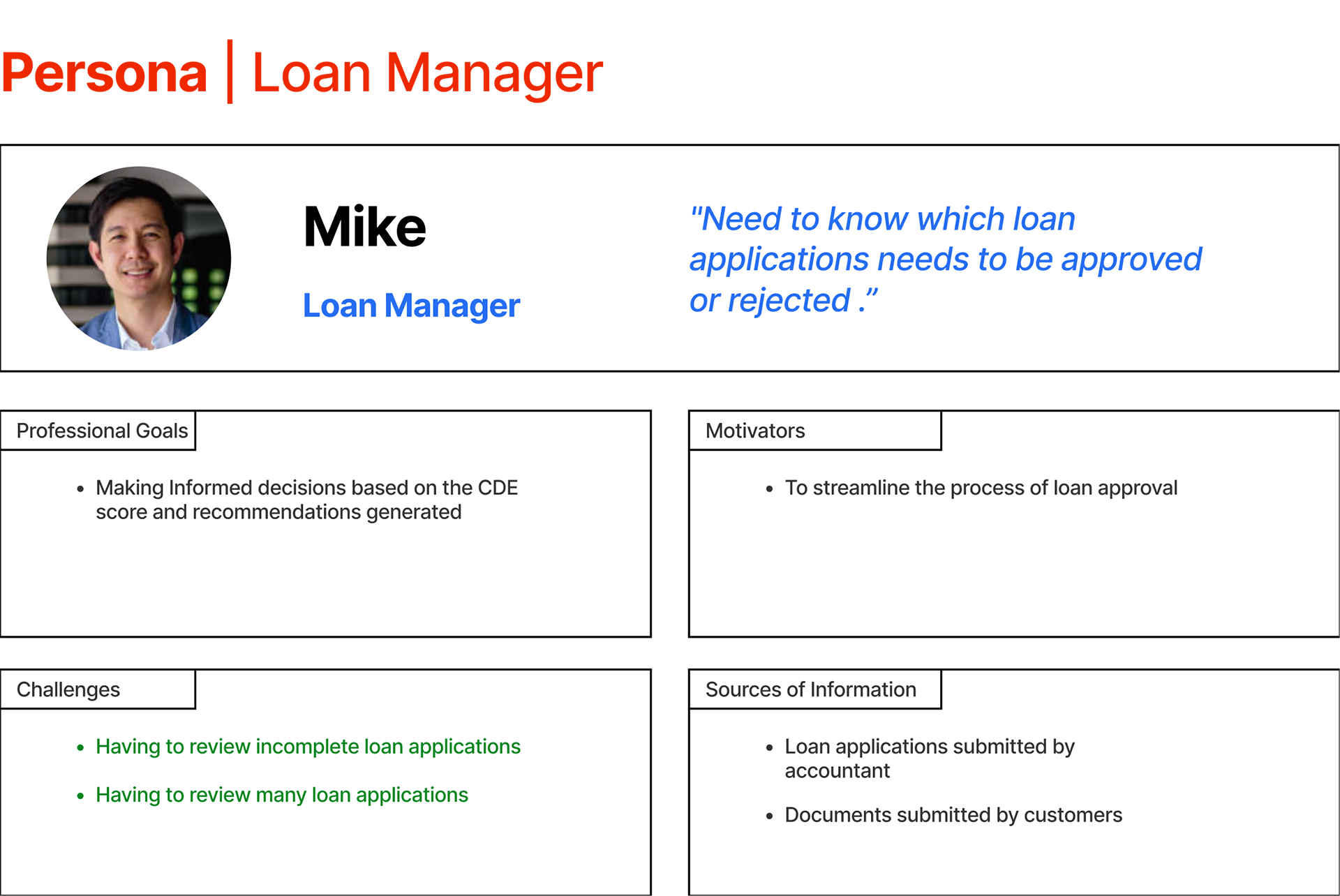

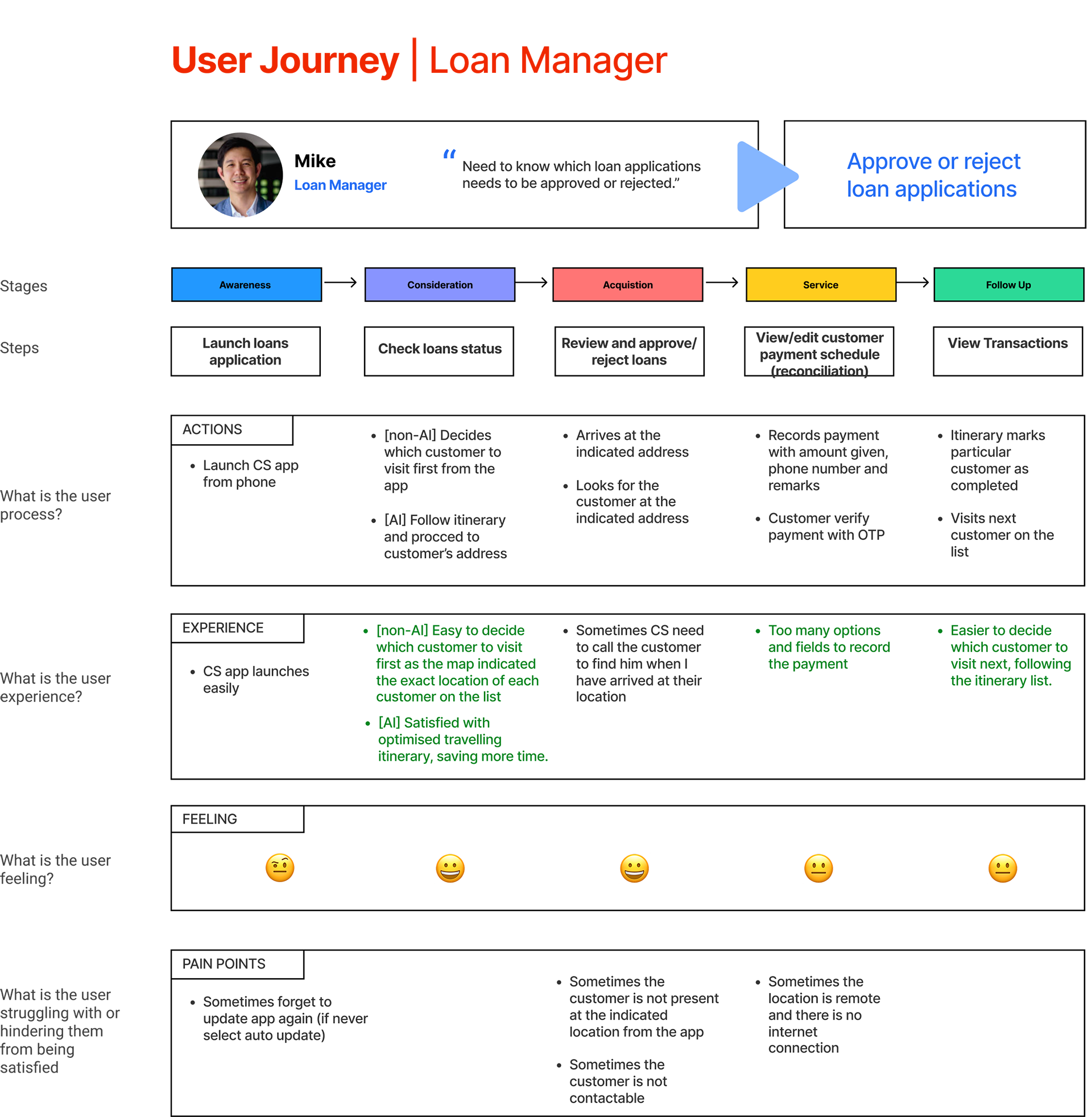

Before the Unified Portal was introduced, the Loan Management System (LMS) was spread across multiple disconnected tasks and interfaces. Loan managers had to navigate separate modules for price lists, sales data, loan disbursement, and inventory, which makes it difficult to track information cohesively. User journeys showed that managers struggled with reviewing large volumes of applications, incomplete data, and unclear approval paths. This fragmented structure led to inefficiencies, slower decision-making, and a heavy reliance on manual coordination between teams.

A loan manager who needs clear, complete information to review and approve loan applications efficiently.

Shows how the loan manager reviews loan statuses, approves applications, and manages customer interactions across multiple steps.

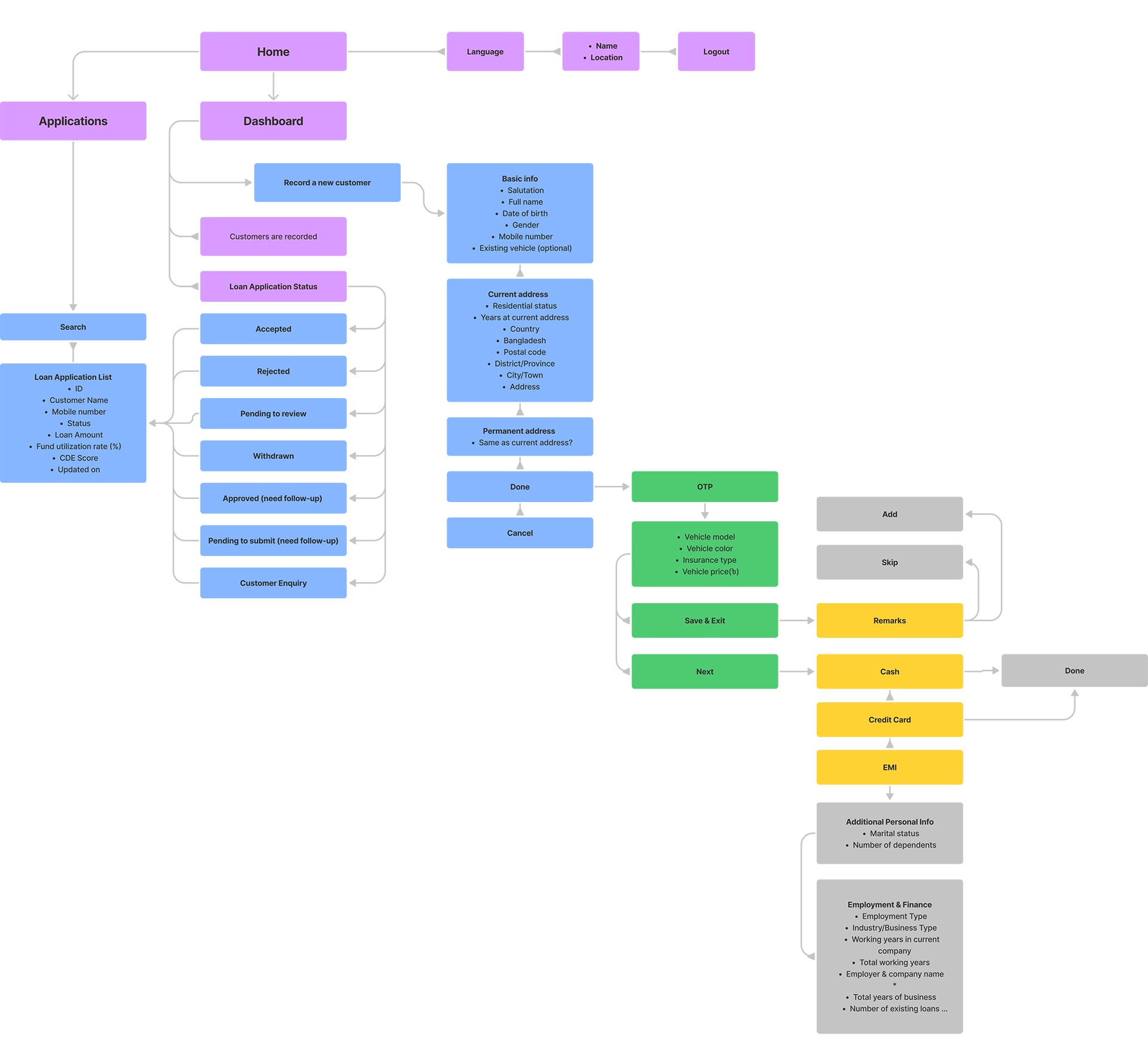

Information Architecture & Wireframing

These early wireframes and the information architecture diagram represent our initial exploration into how the loan application process could be organized. At this stage, the focus was on defining content hierarchy, identifying key steps in the loan review process, and mapping out how users would move between sections. This ideation work helped clarify what information needed to be grouped together, where bottlenecks existed, and how the overall flow could be simplified before moving into high-fidelity design.

Defines the overall structure of the loan application process and maps how users navigate between key steps.

Explores early layout ideas to determine what information appears on each screen and how users interact with the flow.

Reflecting on the process

The process of designing the unified portal took many rounds of meetings and careful planning to map user flows, clarify requirements, and organise the modules into a coherent structure. Given how tedious and confusing the original system was, a large part of the work involved aligning stakeholders, validating assumptions, and making sure every step made sense for real users. This project really showed me how much teamwork, clarity, and patience matter when designing something this complex.